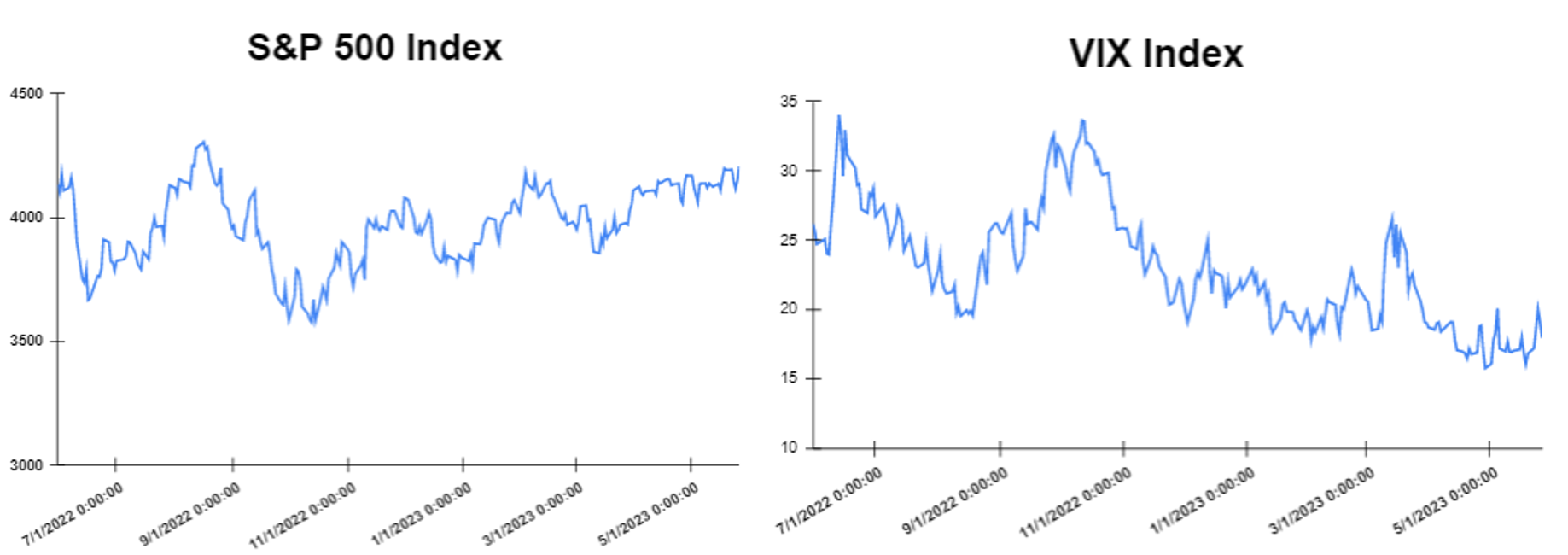

Global markets finished the week higher

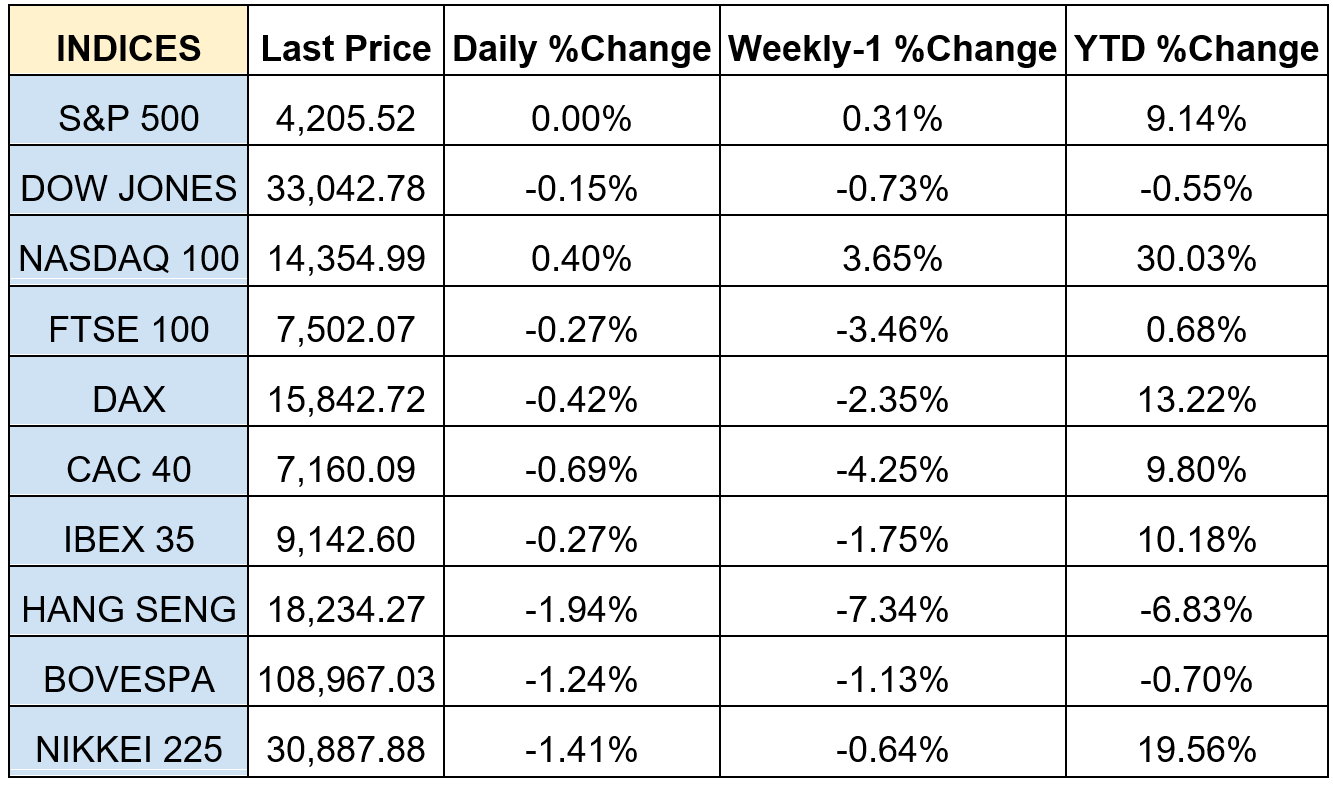

The global markets started the week mostly in red after investors looked toward a possible breakthrough in the Congressional negotiations to raise the debt ceiling to avoid a government default before next month. Moreover, on Wednesday, the United Kingdom Consumer Price Index (CPI) stood at 8.7% on a yearly basis in April higher than expected. The stock markets on that day closed lower as investors are concerned about the global economy. On Thursday, the German economy saw a decrease of 0.3% in the first quarter of 2023 versus the previous trimester. Also, on the same day, the gross domestic product (GDP) of the United States rose by 1.3% in the first trimester of 2023 on an annual level and the number of seasonally adjusted initial jobless claims in the United States increased by 4,000 to 229,000. Lastly, on Friday the Congressional negotiations to raise the United States debt ceiling before the June deadline, came to a halt after Republican negotiators blamed the White House for resisting spending cuts. However, the global markets closed the week with gains. The Dow Jones closed with gain at the closing bell on Friday by 1%. The S&P jumped by 1.31%. Furthermore, the DAX gained 1.20%, the CAC 40 rose by 1.24% and the FTSE 100 advanced by 0.74%. In addition, investors are looking forward to the Eurozone Consumer Price expecting to stand at 7.0%

Treasury yields advanced towards the end of the week

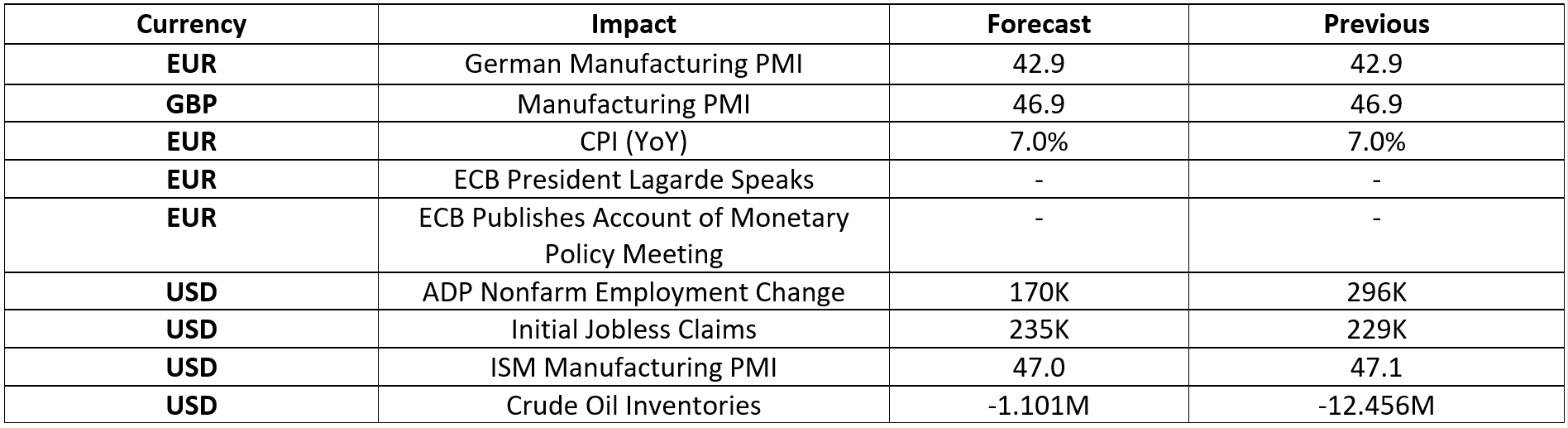

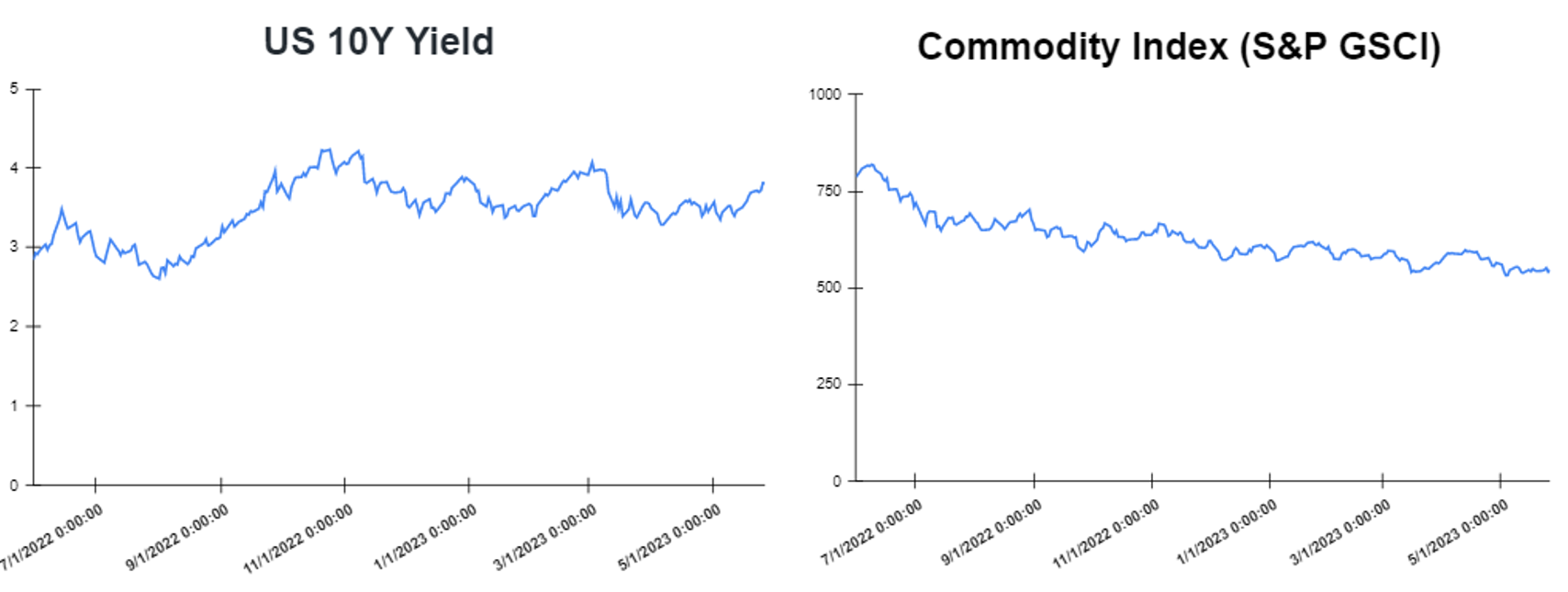

Yields started the week higher as investors monitored debt ceiling deal negotiations and assessed what could be next for Federal Reserve interest rate policy after mixed messages from officials. On Thursday yields rose after the path of the economy as debt ceiling negotiations continued and uncertainty about the interest rate outlook intensified. However, yields were mixed on Friday after investors awaited economic data that could affect Federal Reserve interest rate policy and as debt ceiling deal talks continued. Specifically, on Friday, the yield on the 2-year Treasury increased to 4.568%. Short-term rates are more sensitive to Fed rate hikes. The 10-year Treasury yield, hit 3.810%, falling by about 1 basis points. The 30-year Treasury yield, which is key for mortgage rates, hit 3.9690%. The spread between the US 2’s and 10’s advanced to -75.8bps, while the spread between the US 10-Yr Treasury and the German 10-Yr bond (“Bund”) advanced to – 139.5bps. investors are looking forward to the US Nonfarm Payrolls report on Friday, 2 of June, in which a decreased of 73K is expected.

Volatile week for USD

The US Dollar at the start of the week was flat due to talks between U.S. lawmakers over raising the debt ceiling. In the middle of the week the US Dollar rose as the ongoing risk aversion sentiment continues to support the US Dollar. On Friday, the US dollar finished lower but finished third straight weekly gain as markets raised bets on higher-for-longer interest rates and amid closely watched last-ditch talks on the U.S. debt ceiling. The EURUSD gained to 1.0731, while the GBPUSD increased to 1.2352. Additionally, the USDJPY decreased to 140.60 Yen on Friday.

Oil and Gold traded higher towards the end of the week

Gold started the week almost flat due to sharp losses from Friday’s stronger than expected nonfarm payrolls data. Gold traded lower in the middle of the week after investors waited for the summary of the new statements of the Federal Reserve’s latest meeting. However, Gold traded higher at the end of the week as ongoing negotiations on raising the United States debt ceiling without an apparent conclusion in sight seemingly made them a safety net for investors. Prices of Oil moved lower at the start of the week, after the uncertainty looming over the debt ceiling negotiations in the United States. However, at the end of the week oil moved higher, as concern about the commodity’s supply persisted ahead of the next OPEC+ meeting. Meanwhile, the Crude Oil Inventories report will be released on Thursday which is expected to show an increase of 11.355M.

Stock indices performance

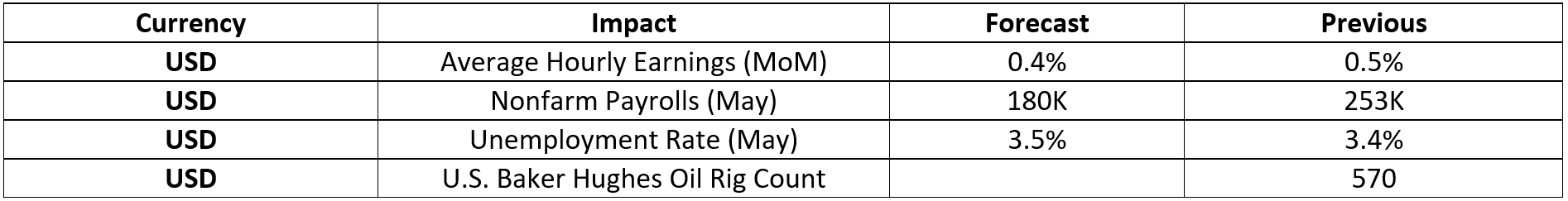

Key weekly events:

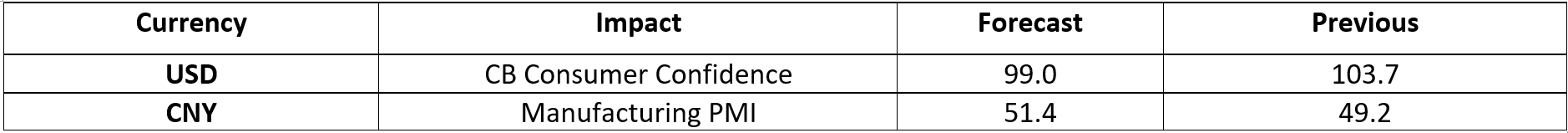

Tuesday – 30 May 2023

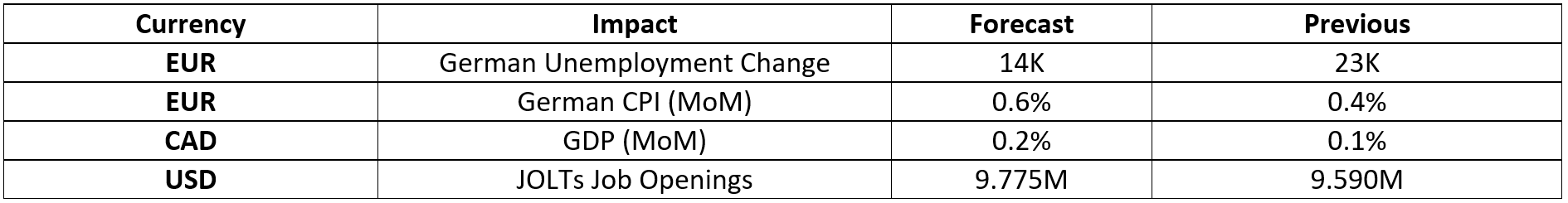

Wednesday – 31 May 2023

Thursday – 01 June 2023

Friday – 02 June 2023

Sources: