Global markets finished the week higher

Global markets started the week mixed as investors waited for more first-quarter corporate reports, economic data and statements by Federal Reserve officials that could indicate where the United States central bank will go when it comes to monetary policy in May. In Europe inflation came to 6.9% as expected on a year to year basis. United Kingdom inflation came to 10.1% higher than expected. However, on Friday the market closed with gains according to PMI data for Germany, the euro area and the United Kingdom showed growth in business activity and investors looked toward the next week’s batch of first-quarter corporate earnings results. Dow Jones traded higher at the closing bell by 0.07% on Friday. The S&P went up by 0.09%. Furthermore, the DAX gained 0.54%, CAC 40 rose by 0.51% and the FTSE 100 advanced by 0.15%. In addition, investors are looking forward to US GDP (QoQ) data which expected a decrease to 2.0% from 2.6%.

Treasury yields advanced towards the end of the week

Yields increased on Friday after the release of the United States PMI, reaching its highest point in 11 months which came to 53.5 in April. On Friday, the yield on the 2-year Treasury increased to 4.182%. Short-term rates are more sensitive to Fed rate hikes. The 10-year Treasury yield, hit 3.568%, up by about 2 basis points. The 30-year Treasury yield, which is key for mortgage rates, hit 3.777%. The spread between the US 2’s and 10’s advanced to -61.4bps, while the spread between the US 10-Yr Treasury and the German 10-Yr bond (“Bund”) declined to – 104.1bps.

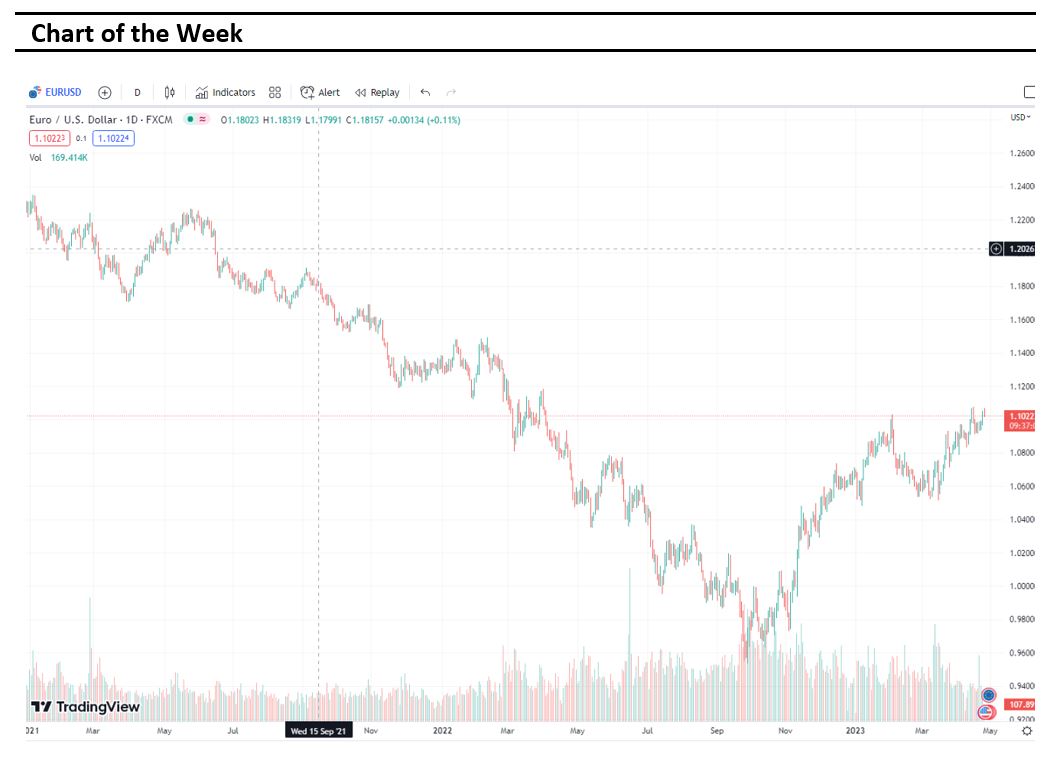

Volatile week for USD

The US Dollar moved sideways after the US showed an increase in Initial Jobless Claims to 245,000. Therefore, on Friday US Dollar was slightly higher as business activity data suggested that the world’s largest economy remained resilient, supporting expectations of another 25-basis-point interest rate increase by the Federal Reserve at next month’s policy meeting. The EURUSD climbed to 1.0982. GBPUSD declined by 0.1% to 1.2431. Additionally, the USDJPY dropped to 134.17 yen on Friday.

Oil and Gold traded lower towards the end of the week

Gold started the week lower after comments from Federal Reserve officials on the path of interest rate hikes triggered a heavy dose of profit taking in the prior session. Gold traded lower at the end of the week after Federal Reserve officials hinted at additional monetary tightening, offsetting optimism that the policymakers could soon wrap up the interest rate cycle. Prices of Oil moved lower at the start of the week, after Federal Reserve Bank of Richmond President Thomas Barkin said that more is still needed to prove that inflation in the United States is on a consistent way down. However at the end of the week, the U.S. rate hike and recession fears have cut into the OPEC+-hyped rally in crude, handing oil bulls their first week of losses after a four-week winning streak. Meanwhile, the Crude Oil Inventories report will be released on Wednesday which is expected to show a decrease of 3.493M.

Stock indices performance

Key weekly events:

Monday – 24 April 2023

Tuesday – 25 April 2023

Wednesday – 26 April 2023

Thursday – 27 April 2023

Friday – 28 April 2023

Sources:

https://www.tradingview.com/

https://breakingthenews.net/Home

https://www.investing.com/

https://www.fxstreet.com/news

https://www.cnbc.com/world/