Global markets finished the week higher

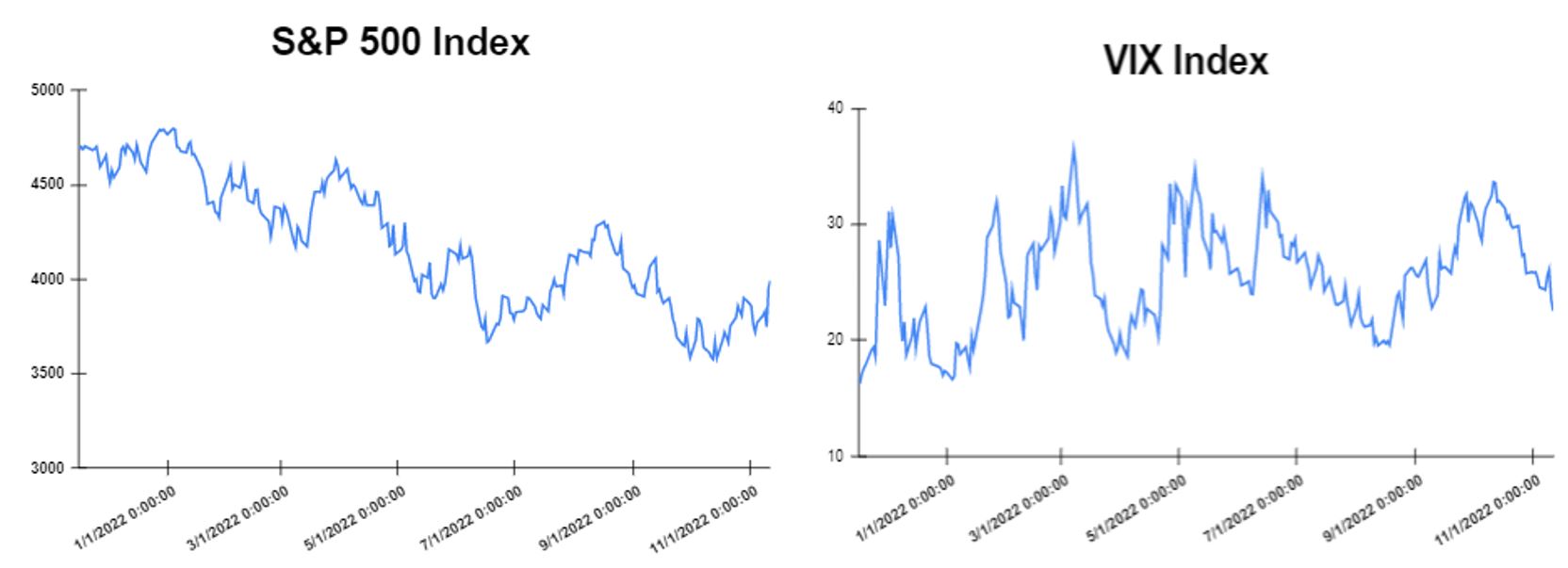

Global markets started the week mostly higher after the release of new economic data on housing, industrial production, and investor confidence in Europe. In addition, investors were bracing themselves for the forthcoming data on inflation to be published this week and ahead of the U.S. midterm elections. Historically, the stock market has tended to perform well following the mid-term election results, no matter which party wins. However, the most important driver of market outcomes this year remains the inflation. Markets were sharply up after the October CPI came in lower than expected. The headline inflation posted a 7.7% y/y increase, compared to the expected 7.9%. In response to this surprise, stocks surged, treasury yields sank and the dollar weekend. The Dow Jones gained 0.10% at the closing bell on Friday. The S&P 500 rose by 0.92%. Moreover, the DAX gained 0.56%. The CAC 40 went up by 0.58% and the FTSE 100 tumbled by 0.78%.

Treasury yields declined towards the end of the week

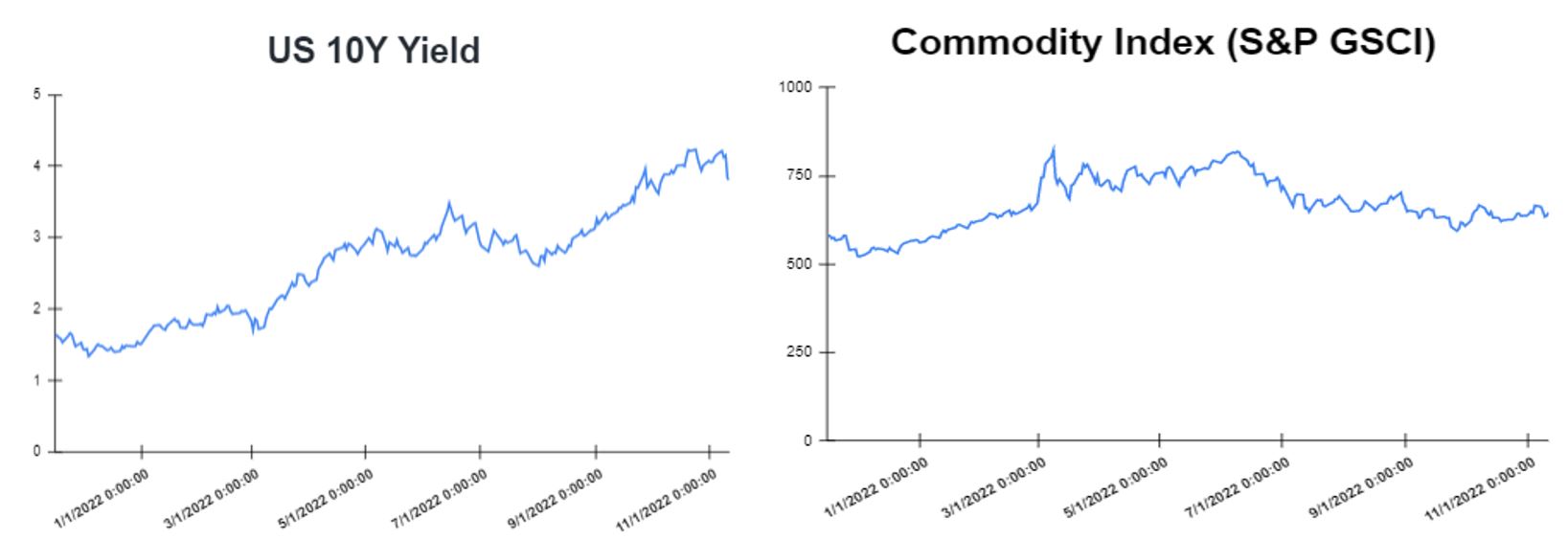

Yields tumbled after Labor Statistics Bureau confirmed the October CPI at a lower-than-expected 7.7%, with the figure dropping for the fourth consecutive month pulled by the Federal Reserve’s strong rate hikes. For investors this was a signal that price increases have possibly peaked and that a slowdown to 0.5% rate hike in December seems to be the most probable move for FED. The yield on the 2-year Treasury dropped to 4.397%. Short-term rates are more sensitive to Fed rate hikes. The 10-year Treasury yield, hit 3.946% down, about 19.6 basis points. The 30-year Treasury yield, which is key for mortgage rates, hit 4.196%. The spread between the US 2’s and 10’s narrowed to -45.1bps, while the spread between the US 10-Yr Treasury and the German 10-Yr bond (“Bund”) tightened to -173.4bps.

Volatile week for USD

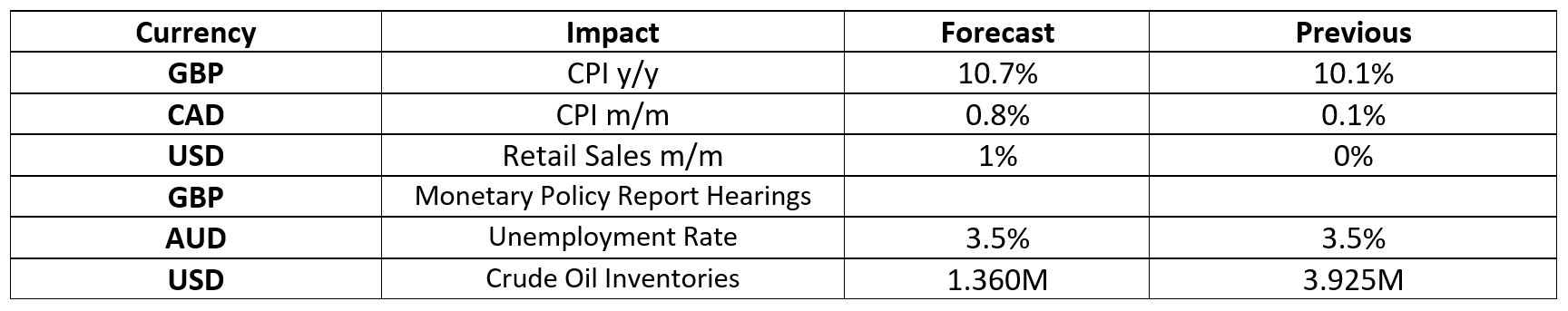

Traders were on risk-on mood after the softer than expected inflation report. The Dollar fell across the board for a second straight day on Friday. Therefore, EUR/USD ended the week higher at 1.036. Moreover, in the United Kingdom the gross domestic product (GDP) decreased by 0.2% in the third quarter, which was significantly above the -0.5% consensus. This was welcomed by the market as the GBPUSD appreciated to 1.1853. The services sector slowed to flat output, while production slid by 1.5% in the three-month period with manufacturing dropping by 2.3%. The USDJPY went on a free fall this week and traded near 138.55 on Friday. Following a period of high volatility for the British pound, the United Kingdom will release CPI Y/Y on Wednesday 16th of November, in which is expected to confirm a rise on inflation by 0.6% to total 10.7%.

Oil and Gold traded higher

Gold started the week with losses as China’s recommitment to its zero-COVID policy ramped up concerns over slowing economic growth and boosted the dollar. Gold traded higher in the middle of the week after United States report on the annual inflation. However, Gold traded higher at the end of the week as of Thursday as U.S. inflation registered its slowest annual reading in nine months, heightening speculation that the Federal Reserve will back off from the aggressive rate hikes it has executed since March, sending the dollar crashing. Prices of Oil traded higher on Monday, as supply concerns stormed the global oil markets once again. However, oil gained more in the middle of the week, as investors digested the cooler-than-expected inflation reading in the United States. The prices of oil futures remained higher on Friday but fell week by week after health authorities in China eased some of the country’s heavy COVID-19 curbs. Meanwhile, in the Crude Oil Inventories report on Wednesday, decrease is expected in the number of barrels held by US firms by 2.565M.

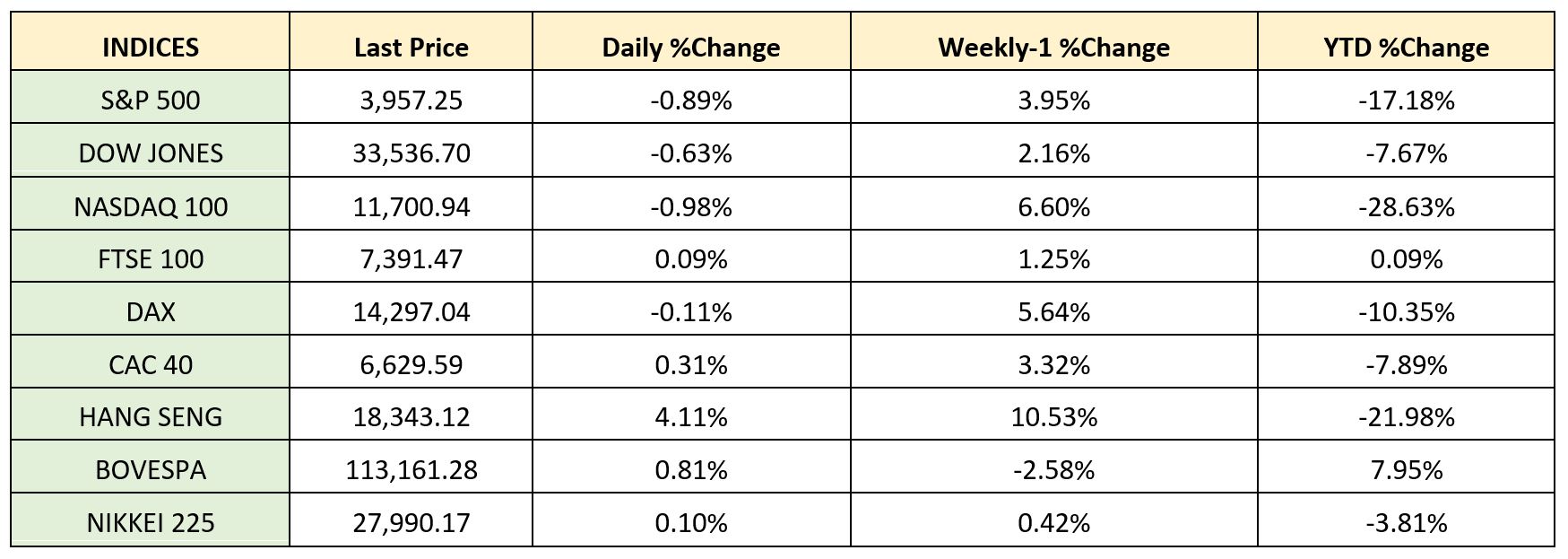

Stock indices performance

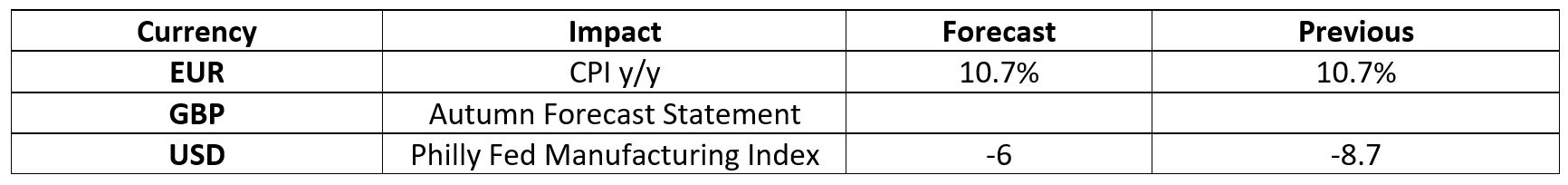

Key weekly events:

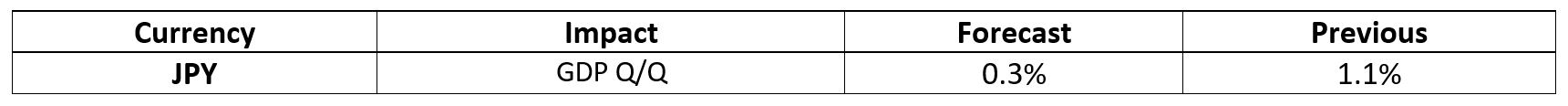

Monday – 14 November 2022

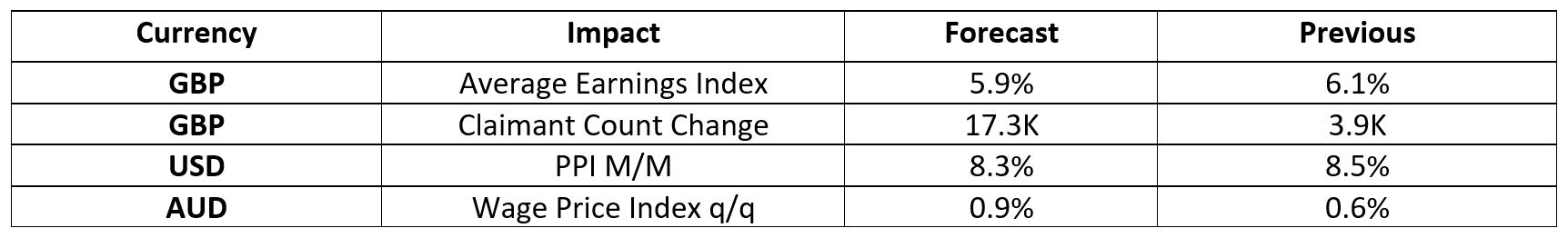

Tuesday – 15 November 2022

Wednesday – 16 November 2022

Thursday – 17 November 2022

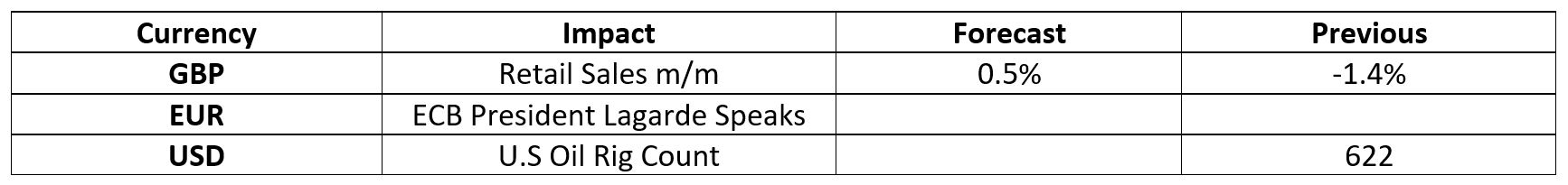

Friday – 18 November 2022

Sources:

https://www.tradingview.com/

https://breakingthenews.net/Home

https://www.investing.com/

https://www.fxstreet.com/news

https://www.cnbc.com/world/

*Disclaimer: The information contained in this publication does not constitute investment advice and is not a personal recommendation from NaxexInvest. Nothing contained herein constitutes the solicitation of the purchase or sale of type of financial instrument. Any investment activities undertaken using this information will be at the sole risk of the relevant investor. NaxexInvest expressly disclaims all liability for the use or interpretation (whether by visitor or by others) of information contained herein. Decisions based on this information are the sole responsibility of the relevant investor. Any visitor to this page agrees to hold NaxexInvest and its affiliates and licensors harmless against any claims for damages arising from any decisions that the visitor makes based on such information.