Global markets finished the week mixed

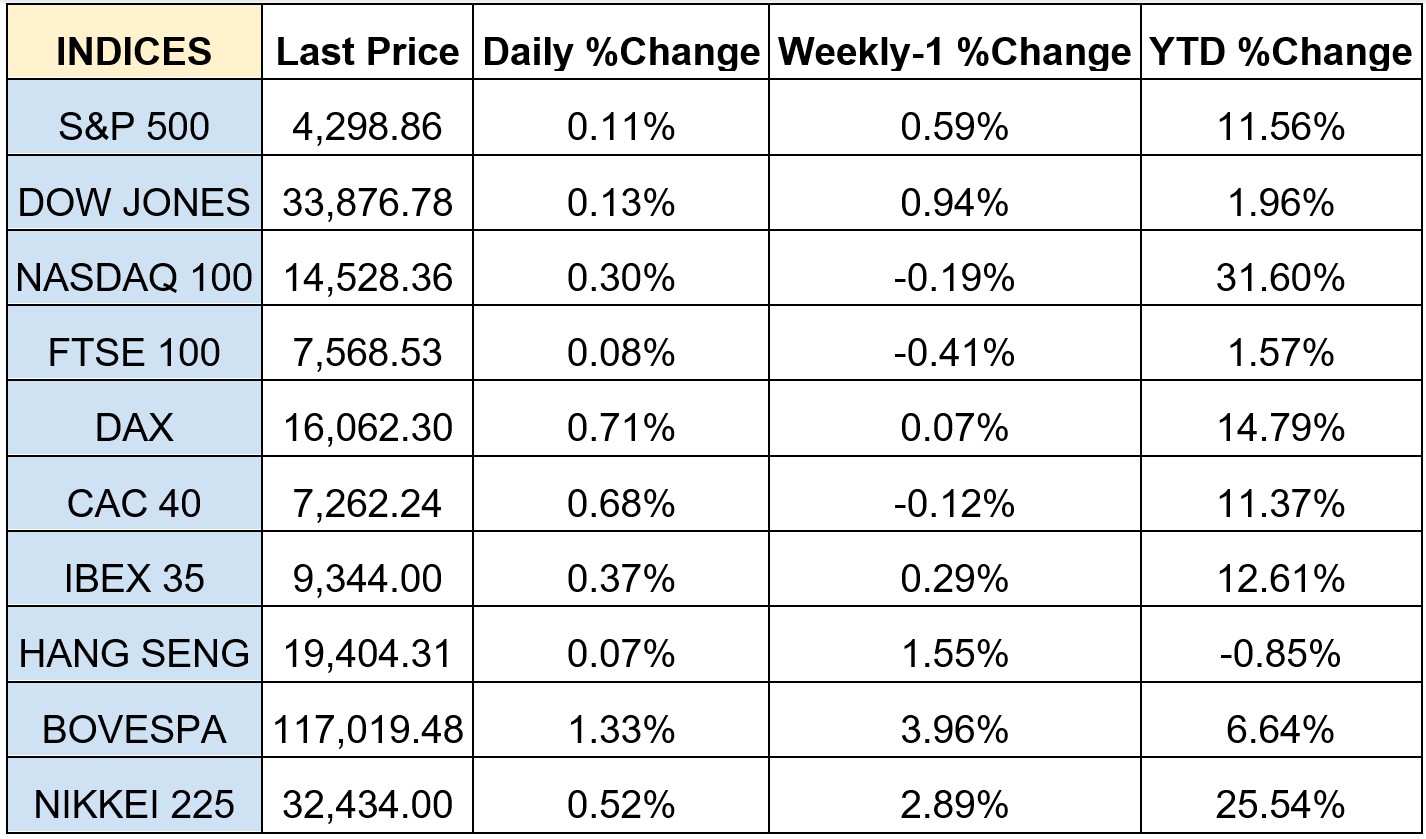

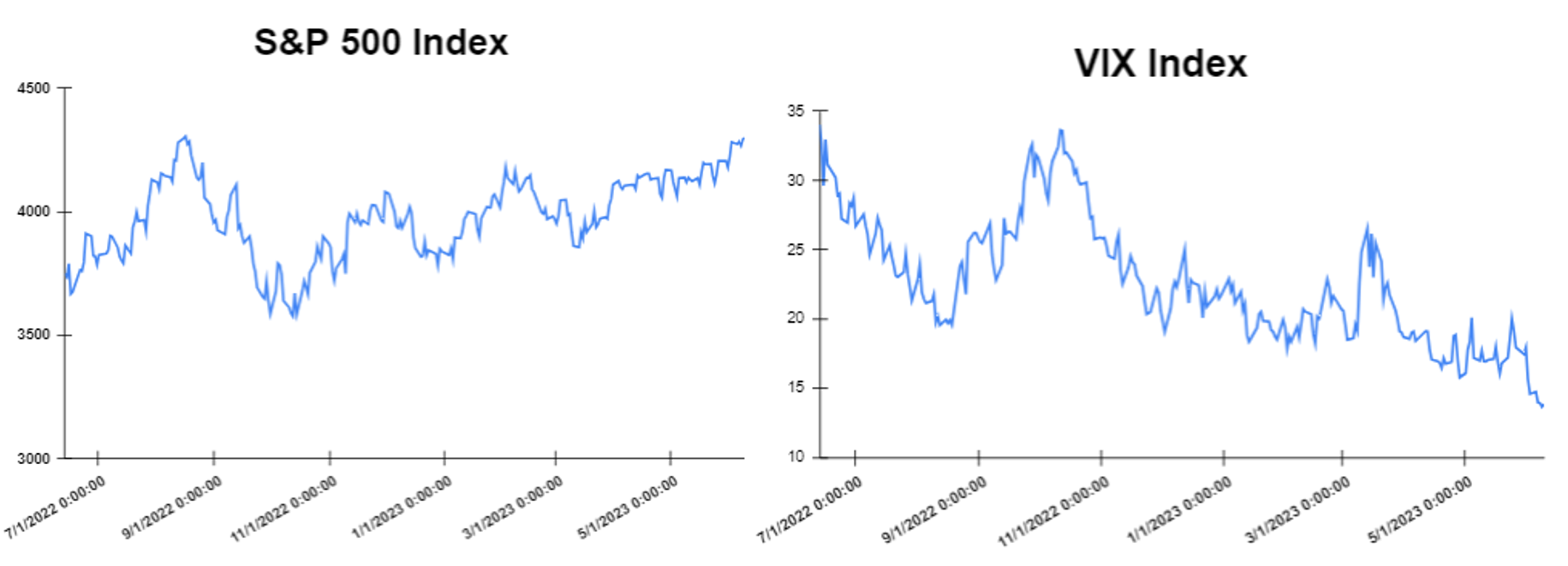

The global markets started the week lower, after data showed that the services sector in the United States expanded at a slower pace, adding to concerns about the stability of the country’s economic condition. Also on Monday, the Purchase Managers’ Index (PMI) came in at 50.3%, 1.6 percentage points lower than in April and slightly lower than expected, signalling a slowdown in the growth of the US services sector. On the same day, the private sector activity in the United Kingdom (PMI) softened in May, led by a drop in manufacturing production, declining to 54 from 54.9 in April. Moreover, on Wednesday, the Bank of Canada announced that it has decided to raise its key interest rate by 25 basis points to 4.75% while stating that it will continue with its policy of quantitative tightening. Furthermore, House prices in the United Kingdom decreased by 1% in May, on an annual basis, according to the Halifax House Price Index report on Wednesday, with the reading being negative for the first time since December 2012. On Thursday, the GDP growth was revised down to 1%, on a yearly basis, both in the Eurozone and in the EU from 1.3% and 1.2% respectively. Also, on the same day, the number of seasonally adjusted initial jobless claims in the United States jumped by 28,000 to 261,000, more than expected and this was the highest level since October 2021. Lastly, on Friday, the stock markets ended the week mixed, leaving markets to focus on upcoming inflation and Fed announcements. On June 14, the Fed will announce its interest rate decision and most traders seem to be expecting a pause in the rate-hiking process. Moreover, the European stocks ended Friday’s session in the red territory following Thursday’s news from Eurostat that the Eurozone’s economy entered recession at the start of the year. The Dow Jones closed with a gain of 0.13% at the closing bell on Friday. The S&P jumped by 0.11%. Furthermore, the DAX declined by 0.25% and the CAC 40 dropped by 0.12%. The FTSE 100 lost 0.49%.

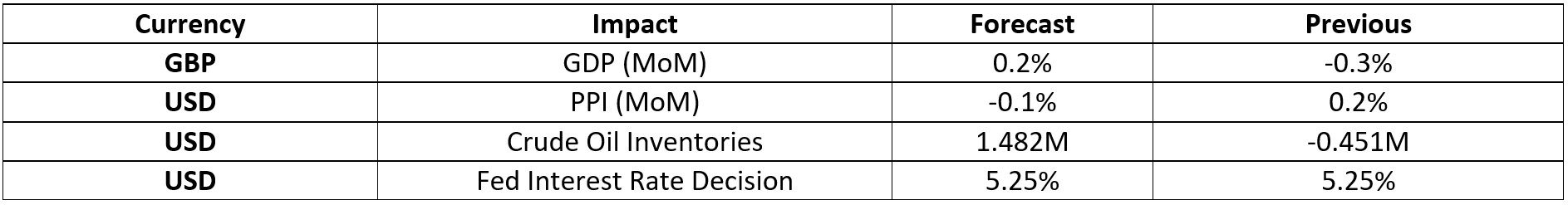

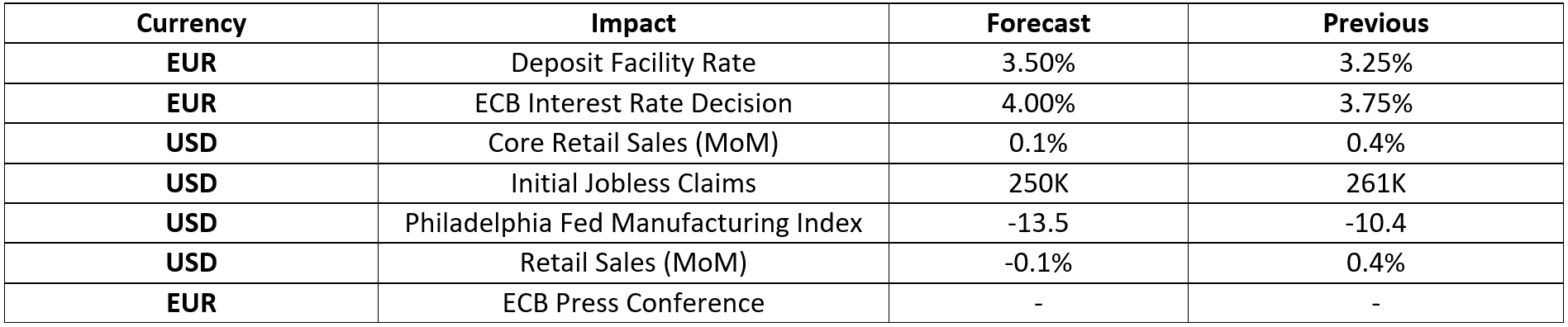

In addition, investors are looking forward to the ECB Interest Rate Decision expecting an increase to 4.00% from 3.75%. while the Fed is expected to keep the interest rates at 5.25%.

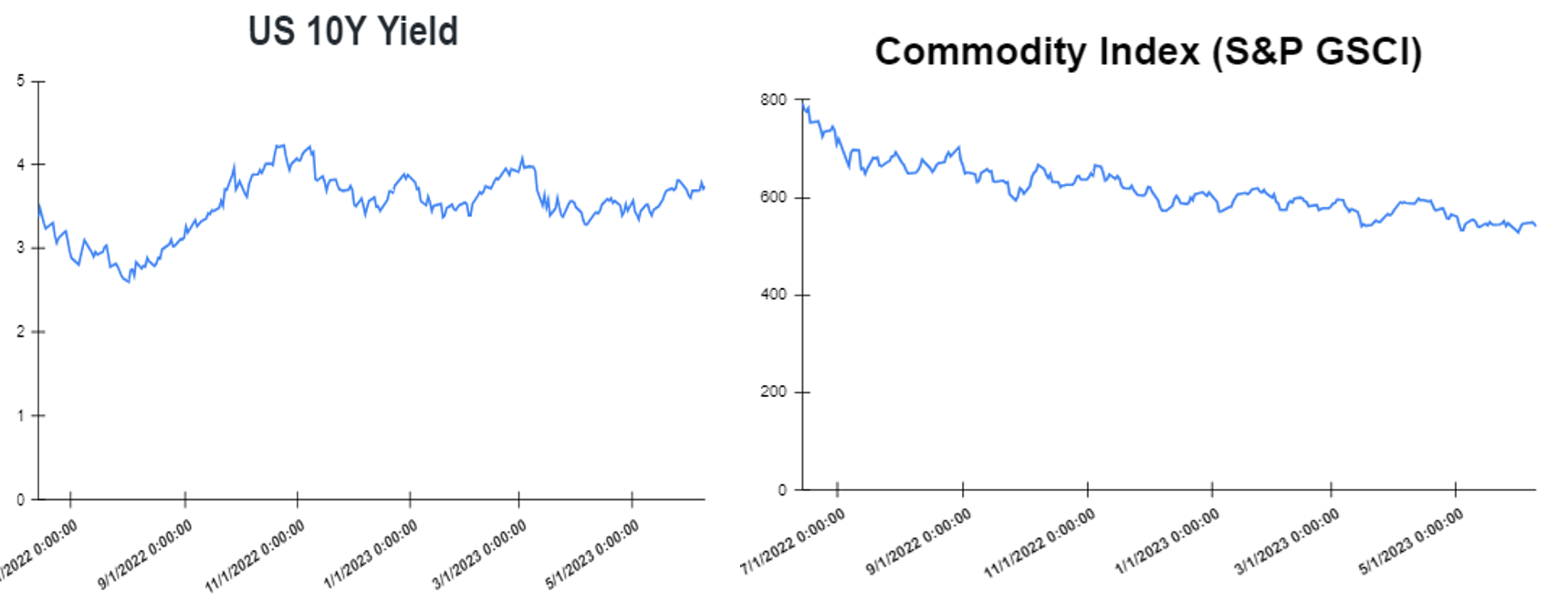

Treasury yields advanced towards the end of the week

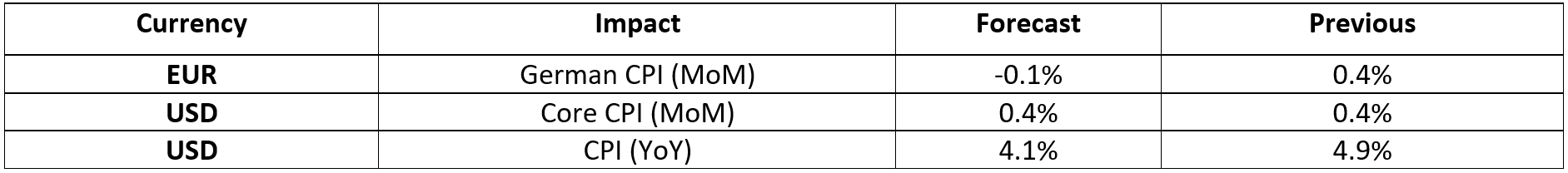

Yields started the week lower as investors monitored the path for interest rates and weighed key economic data that could affect the Federal Reserve’s next policy moves. However, yields closed the week higher on Friday after looking ahead to the Federal Reserve monetary policy meeting next week, where officials will announce a fresh interest rate decision. Specifically, on Friday, the yield on the 2-year Treasury increased to 4.606%. Short-term rates are more sensitive to Fed rate hikes. The 10-year Treasury yield, hit 3.747%, advanced by about 3 basis points. The 30-year Treasury yield, which is key for mortgage rates, hit 3.8870%. The spread between the US 2’s and 10’s advanced to -85.9bps, while the spread between the US 10-Yr Treasury and the German 10-Yr bond (“Bund”) advanced to – 139.bps. In addition, investors are looking forward to US CPI (YoY) on Tuesday which is expected to decrease to 4.1% from 4.9%.

Volatile week for USD

The US Dollar at the start of the week was lower due to economic data from the US weighing on the US dollar. In the middle of the week the US Dollar rose as the US Treasury yields surged. On Friday, the US dollar finished higher as investors awaited inflation data and the Federal Reserve’s interest rate decision next week. The EURUSD declined to 1.0749, while the GBPUSD increased to 1.2576. Additionally, the USDJPY increased to 139.40 Yen on Friday.

Oil and Gold traded higher towards the end of the week

Gold started the week higher due to the release of disappointing ISM Services PMI data for May. However, Gold traded lower at the end of the week after the expectations for the pause on rate hikes by the Federal Reserve acted as a tailwind for Gold, while rising US bond yields limit its upside potential. Prices of Oil moved higher at the start of the week after the world’s top exporter Saudi Arabia pledged to cut production by a further 1 million barrels per day (bpd) from July. However, at the end of the week oil moved higher, after the White House denied a report claiming that a nuclear deal between the U.S. and Iran was in the offering. Meanwhile, the Crude Oil Inventories report will be released on Wednesday which is expected to show an increase of 1.933M.

Stock indices performance

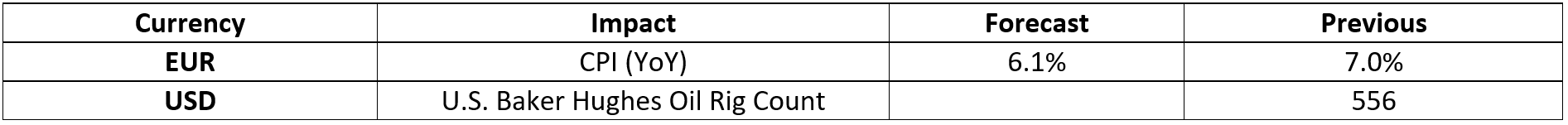

Key weekly events:

Tuesday – 13 June 2023

Wednesday – 14 May 2023

Thursday – 15 June 2023

Friday – 16 June 2023

Sources:

https://www.tradingview.com/