There is an ongoing debate in the financial world regarding stock splits. On one hand, you have big investors like Warren Buffett who hate stock splits, and on the other hand, previous stock splits like Amazon’s splits in the late 90’s make the case against this notion.

In the late ’90s, Amazon executed three splits in quick succession, beginning with a 2-for-1 split in in 1998, when the shares were worth about $86 a piece. Amazon has grown quite a bit since then. As of March 10th, one share of its stock is worth $2,933. That means your original $860 investment would now be worth about $351,960 today.

Since the start of the Covid-19 pandemic, Wall Street experienced a massive inflow of retail investors. At the same time as this inflow occurred, tech-stocks rose at high speeds in a short period of time. Apple and Tesla split 4-for-1 and 5-for-1 respectively on the same date, August 2020. Chip maker Nvidia followed suit with a 4-for-1 split in July 2021.

Alphabet, the parent company of Google, announced a 20-for-1 stock split along with its quarterly earnings report on February 1st 2022. Not too long after that announcement, on Thursday 10th March 2022, Amazon stock shot higher in after-hours trading on some big news saying that the company’s Board of directors is going to enact a 20-to-1 split, just like Alphabet.

AMAZON

ALPHABET

For Amazon (AMZN) shareholders the close of business on May 27th 2022 is the “record date”, meaning that the split will take place on June 3, while the trading on a split-adjusted basis (20-for-1)) will happen on the 6th of June. Please note that if you buy AMZN shares after the record date, you will not be “on record” for the split adjustment, implying that your AMZN shares will not be subject to the stock-split. Consecutively, for Alphabet (GOOGL)stockholders the “record date” is set on July 1st 2022, the split-adjusted basis will happen on Friday July 15th and the trading on the split-adjusted basis (20-for-1) will commence on July 18th. Both corporate actions (stock splits) require prior shareholder approval.

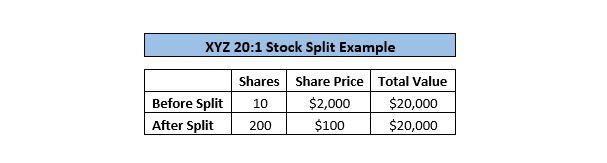

What is actually a stock split and what are the potential benefits from splitting a stock? A stock split is a decision by a company’s board of directors to increase the number of shares outstanding by issuing more shares to current shareholders.

The “pie” example explains a stock split in a simple way. The pie represents the entire company. Each share is a slice of the pie. A stock split is the act where the company takes each slice of the pie and cuts it into even smaller pieces. The pie is still the same size, it just has more smaller size pieces.

The case made for stock splits is that it makes it more attractive and affordable to retail investors. Many small beginning investors start investing in smaller amounts. A lot of them could possibly afford one single stock of these companies at current prices, or even just a fraction of those shares with their current investment budget. Another reason is that it makes it easier to manage portfolios, by allowing flexible rebalancing of positions by selling a portion of a holding in a single share, if the price is smaller. A high per-share price makes it more difficult as it may take out a lager chunk of the entire portfolio in a case where rebalancing is required. Finally, stock splits such as Apple, Nvidia and Tesla have shown a tendency to outperform the market shortly afterwards, which makes the case that stock splits usually help companies to grow their market cap.

The debate for stock splits will always be present and only time will tell what the success rate of Alphabet and Amazon splits will be for investors this time around.

Sources

reuters.com, forbes.com, qz.com, seekingalpha.com, fool.com, thestreet.com, investorplace.com, coronadotimes.com, grow.acorns.com, tradingview.com .

*Disclaimer: The information contained in this publication does not constitute investment advice and is not a personal recommendation from NaxexInvest. Nothing contained herein constitutes the solicitation of the purchase or sale of type of financial instrument. Any investment activities undertaken using this information will be at the sole risk of the relevant investor. NaxexInvest expressly disclaims all liability for the use or interpretation (whether by visitor or by others) of information contained herein. Decisions based on this information are the sole responsibility of the relevant investor. Any visitor to this page agrees to hold NaxexInvest and its affiliates and licensors harmless against any claims for damages arising from any decisions that the visitor makes based on such information.